dependent care fsa coverage

The employee will generally have eligible dependent care FSA expenses for the services provided prior to the day the child reaches age 13. The TexFlex health care FSA is administered.

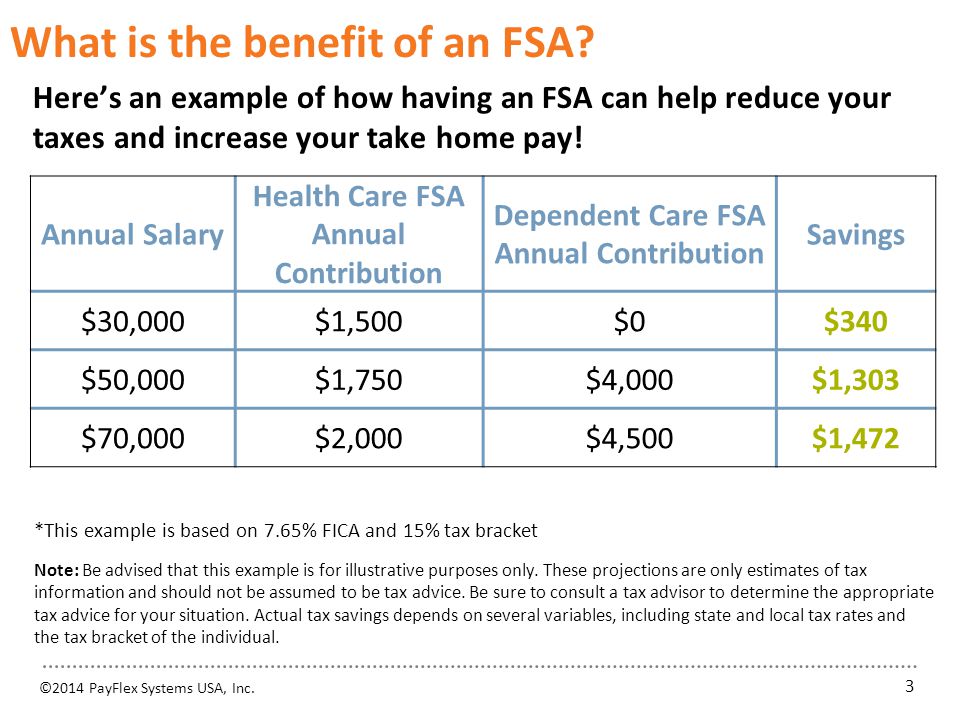

Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses.

. But employers may offer either. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. Your family is completely taken.

The care of a spouse or dependent of any age who is physically or mentally. Healthcare Healthy Living Store. Ad Largest Selection Of FSA Eligible Health And Wellness Products Easy Buy Health Supplies.

Ad pdfFiller allows users to edit sign fill and share all type of documents online. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

By Alicia Main March 23rd 2021. Watch this short video to learn how to get the most from your Flexible Spending Account. Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions.

A Dependent Care FSA DCFSA is a type of flexible spending account that provides tax-free money for. As a new hire you will enroll online through Wolverine Access New Hire Benefits Self-Service for everything except flexible spending. You and your spouse together can contribute up to 5000 to a dependent-care FSA for the year not 5000 each.

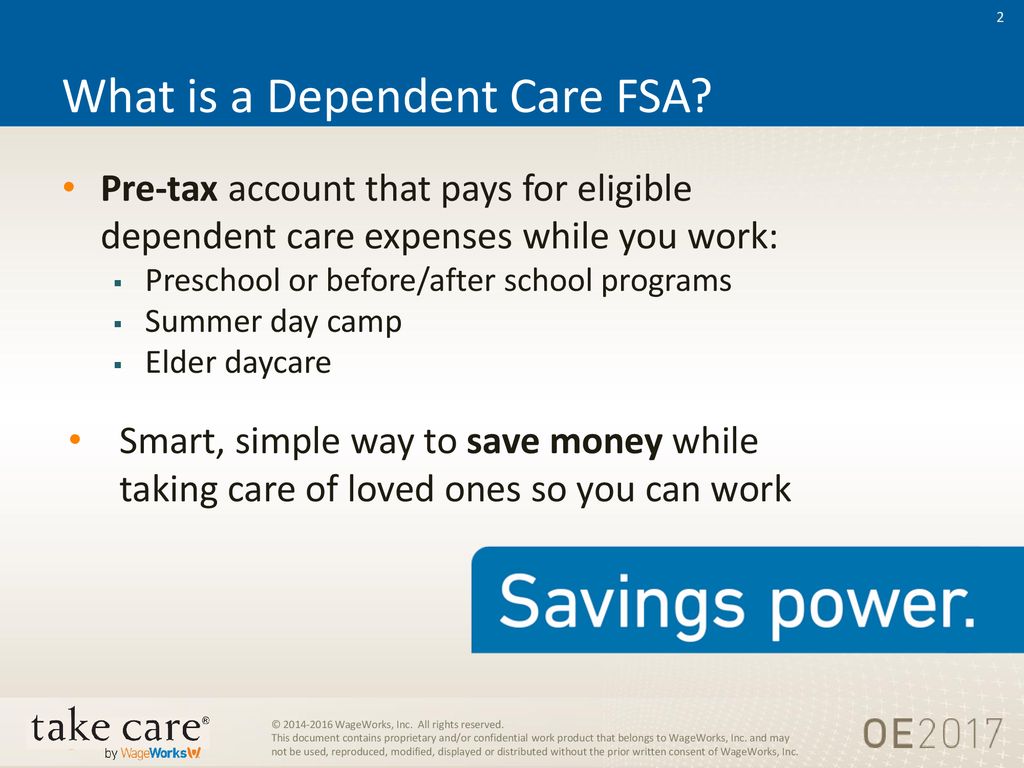

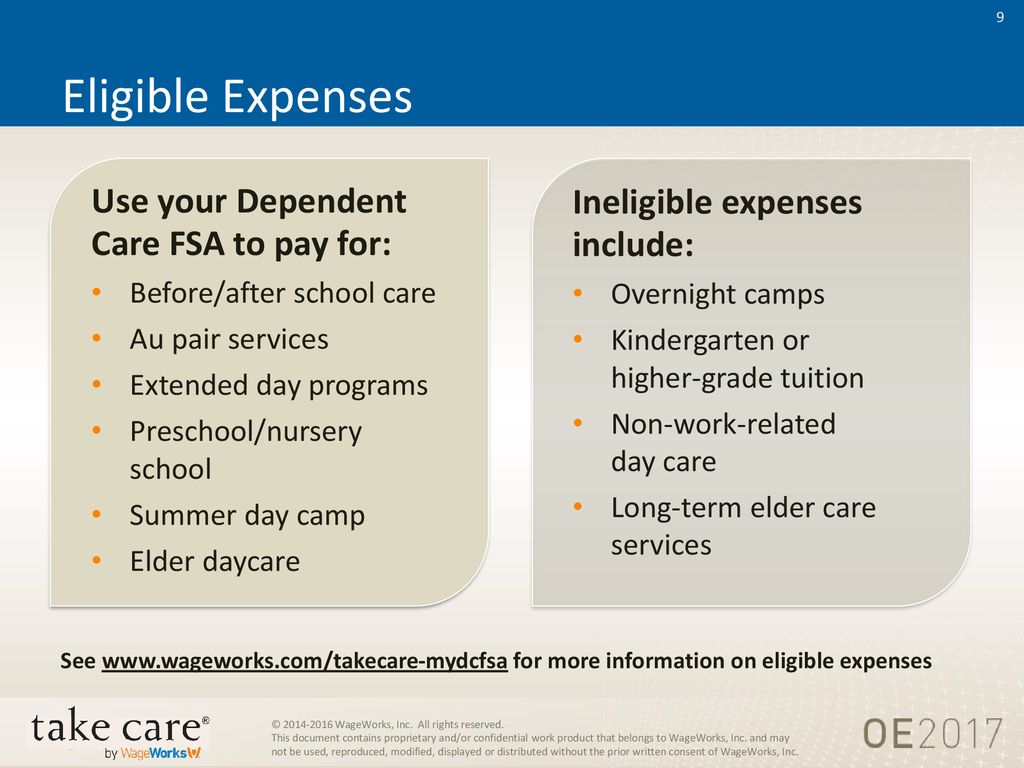

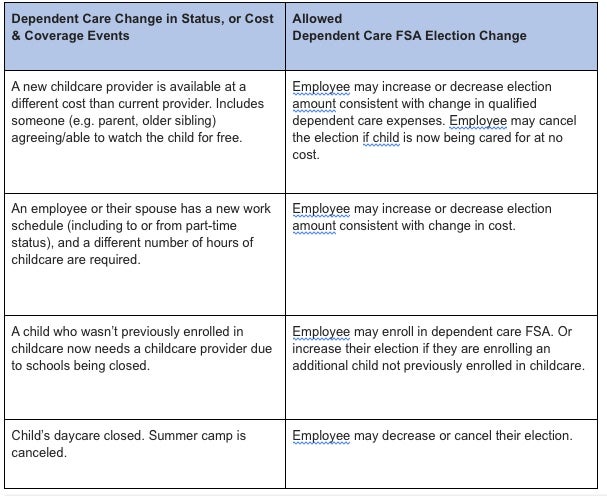

Unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42. The amount you contribute to your take care by WageWorks Dependent Care FSA cannot be changed during the year unless you experience a change in status or a change in the cost or. This account helps you pay for costs such as dependent care before and after school care nursery school preschool and summer day camp.

Your account is funded by. Adult daycare for parentsrelatives who you declare as a dependent. Your employer deducts this amount from each paycheck before taxes.

A dependent care FSA can help you put aside dollars income tax- free for the care of children under 13 or for dependent adults who cant care for themselves. And as with medical FSAs you usually lose what you dont. A Day Care Flexible Spending Account FSA is a pre-tax benefit that enables you to set aside money to pay for your out-of-pocket day care or dependent care expenses.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including. You may enroll in coverage for yourself as well.

A dependent care FSA DCFSA provides tax savings for the care of your children a disabled spouse or legally dependent parent during your working hours. Provisions for Dependent Care FSAs and COBRA. American Rescue Plan Act of 2021.

In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing. Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions. Unlike the FSA dependent care elections can be changed throughout the plan year without qualifying events.

On March 11 the American Rescue Plan Act ARPA of 2021 was. With a dependent care FSA you choose how much to contribute up to a maximum of 5000 per household per year. Ad Find Medicare Advantage Plans Option for You Your Budget.

Shop Now To Save More. Call Now Get Matched with a Local Insurace Agent to Help you Find your Medicare Plan. Learn about Dependent Care FSAs Health Care FSAs and Limited Purpose FSAs.

1 PDF editor e-sign platform data collection form builder solution in a single app. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and.

Enrollment Information 24hourflex

Flex Spending Accounts Hshs Benefits

Employer Provided Dependent Care Fsa Benefit Plans Optum Financial

Why You Should Consider A Dependent Care Fsa

Dependent Care Flexible Spending Account

Dependent Care Fsa University Of Colorado

Health Care And Dependent Care Fsas Infographic Optum Financial

Dependent Care Fsa Flexible Spending Account Ppt Download

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

How To File A Dependent Care Fsa Claim 24hourflex

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Your Flexible Spending Account Fsa Guide

This Presentation Covers Ppt Download

What Is A Dependent Care Fsa Wex Inc

Dependent Care Fsa Dcfsa Optum Financial